Andy Altahawi's recent decision to launch his company on the New York Stock Exchange (NYSE) through a direct listing has sent shockwaves throughout the financial world. This unique approach, eschewing conventional IPO methods, is seen by many as a daring move that disrupts the existing system of public market offerings.

Direct listings have become momentum in recent years, particularly among companies seeking to avoid expenses associated with traditional IPOs. Altahawi's decision emphasizes this trend, suggesting a growing preference for more efficient pathways to going public.

The move has captured significant attention from investors and industry analysts, who are closely watching to see how Altahawi's direct listing will affect the company's trajectory. Some argue that the move could reveal significant value for shareholders, while others stay cautious about its long-term success. read more Only time will tell whether Altahawi's direct listing will be a game-changer for his company and the broader financial landscape.

Altahawi & Co. Eyes NYSE, Bypassing Traditional IPO Path

In a move that signals ambition and boldness, Altahawi & Co., the burgeoning financial services/technology firm, is setting its sights on a listing on the New York Stock Exchange (NYSE). This forward-thinking move represents a departure from the traditional initial public offering (IPO) route, highlighting the company's confidence in its unique approach. Sources indicate Altahawi & Co. is exploring innovative financing options, potentially leveraging special purpose acquisition companies (SPACs) to expedite its journey to public markets.

- The implications of Altahawi & Co.'s strategy remain to be seen, but it is already generating considerable buzz in the investment community.

- Companies across various sectors are increasingly opting for alternative listing mechanisms

NYSE Set for Initial Public Offering of Andy Altahawi's Company

Investors are waiting to see the debut of Andy Altahawi's company, which is set for a traditional IPO on the NYSE. Altahawi, a experienced entrepreneur, has built his company into a promising success in the technology sector. Experts are optimistic about the company's potential, and the launch is expected to be a major occurrence for both the company and the NYSE.

The Altahawi Phenomenon: Will Direct Listings Reign Supreme?

The recent surge in direct listings, spearheaded by prominent names like Spotify and Slack, has sparked a debate within financial circles. Proponents argue that this novel approach to going public offers significant perks for both companies and investors. Conversely, critics raise concerns about the potential challenges associated with direct listings, particularly in terms of market stability.

- Furthermore, the Altahawi Effect, named after the founder of OpenSea who famously opted for a direct listing, suggests that this trend could potentially reshape the traditional IPO landscape.

- Whether direct listings will truly become the new normal remains to be seen. However, their growing acceptance indicates a transformation in the way companies choose to access public capital.

Examining Andy Altahawi's NYSE Direct Listing Method

Andy Altahawi has emerged as a prominent figure in the financial world, known for his innovative and sometimes controversial approaches to capital markets. His recent foray into direct listings on the New York Stock Exchange (NYSE) has garnered significant attention, with many investors and analysts closely following his every move. Altahawi's strategy stands apart from traditional IPOs by bypassing underwriters and allowing companies to directly offer their shares to the public. This bold approach has proven positive outcomes for some, but it remains a risky proposition for others.

Altahawi's history in direct listings is impressive, with several companies under his direction achieving strong initial valuations. However, critics argue that the lack of an underwriter can lead to fluctuations in share prices and exacerbated market risk. Despite these concerns, Altahawi remains unwavering about the future of direct listings, believing that they offer a transparent path to public markets for innovative companies.

- Nevertheless the controversy surrounding his methods, Altahawi's influence on the capital markets is undeniable.

- Her strategies have disrupted traditional IPO processes, and their impact will likely endure for years to come.

Analyst Predictions: Will Altahawi's Direct Listing turn out to be a Success?

The upcoming direct listing of Altahawi has analysts speculating. While some predict the move could yield significant value for shareholders, others voice concerns about the unfamiliarity of the approach. Factors such as market conditions, investor outlook, and Altahawi's performance to handle the listing process will ultimately determine its success. Only time will tell whether Altahawi's direct listing will establish a trend for other companies seeking an alternative path to the public markets.

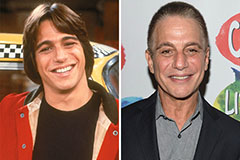

Tony Danza Then & Now!

Tony Danza Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Pauley Perrette Then & Now!

Pauley Perrette Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now!